With 3.8 million Bpd of refining capacity and more than 3.5 million Bpd of oil supply either from within PADD II, or from near by Canada, PADD II refiners (ex Marathon (“MPC”), Phillips 66 (“PSX”), and BP (“BP”) are geographically well positioned to absorb much of the increasing oil production from the oil sands in Western Canada, and the Bakken and Utica formations.

This said, over the next 10-20 years, total oil production from these regions is expected to more than double, with the great majority of this increased production being heavy oil from the oil sands. To take advantage of this, many of the PADD II refiners who have low average Nelson Complexity ratings, are retooling some of their refineries to be able to handle some of the cheaper heavier grades of crude. The Nelson Complexity Index measures a refinery’s ability to process inferior quality crude or heavy sour crudes. It also measures a refinery’s ability to produce a high percentage of LPG, light distillates and middle distillates and low percentage of heavies and fuel oil.

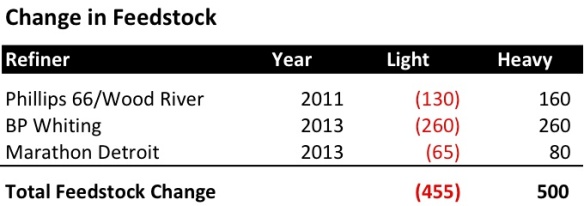

This said, over the next 10-20 years, total oil production from these regions is expected to more than double, with the great majority of this increased production being heavy oil from the oil sands. To take advantage of this, many of the PADD II refiners who have low average Nelson Complexity ratings, are retooling some of their refineries to be able to handle some of the cheaper heavier grades of crude. The Nelson Complexity Index measures a refinery’s ability to process inferior quality crude or heavy sour crudes. It also measures a refinery’s ability to produce a high percentage of LPG, light distillates and middle distillates and low percentage of heavies and fuel oil. To date, three PADD II refiners have announced capital plans which will allow them to take advantage the price differential between the cheaper heavier crudes which come from Canada and the lighter crudes which these refineries had been importing from PADD III. Even if PADD II refiners displace all of the crude oil they currently import from PADD III, Western Canadian producers will still have to find buyers for this incremental production. With over 9 million Bpd of refining capacity and the ability to process heavier crude oils like the oil produced by the Canadian oil sands, the PADD III refineries on the USGC would seem to an optimal home for this incremental North American oil production.

To date, three PADD II refiners have announced capital plans which will allow them to take advantage the price differential between the cheaper heavier crudes which come from Canada and the lighter crudes which these refineries had been importing from PADD III. Even if PADD II refiners displace all of the crude oil they currently import from PADD III, Western Canadian producers will still have to find buyers for this incremental production. With over 9 million Bpd of refining capacity and the ability to process heavier crude oils like the oil produced by the Canadian oil sands, the PADD III refineries on the USGC would seem to an optimal home for this incremental North American oil production.

In order for Canadian oil producers to be able to take advantage of the 9 million Bpd refining market in PADD III, there needs to be sufficient cross border pipeline to import the oil into the US. Additionally, there needs to be sufficient north to south pipeline connectivity to bring the crude from the upper Midwest to the USGC.

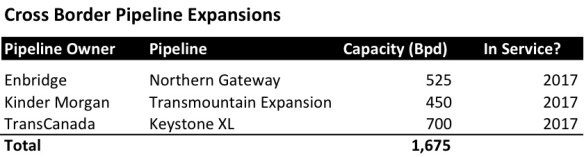

With just 2.5 million Bpd of current oil imports from Canada and 3.8 million Bpd of current Canada-US pipeline capacity in operation, over 1 million Bpd of excess cross boarder capacity would seem to be sufficient. However, with Canadian production expected to double, and with the long lead times which are often needed to build a pipeline, it’s important keep ahead of this production increase to keep as much of the oil in North America as possible. Regardless of this sentiment, three pipeline expansions totaling nearly 1.5 million Bpd of capacity are in development.

With just 2.5 million Bpd of current oil imports from Canada and 3.8 million Bpd of current Canada-US pipeline capacity in operation, over 1 million Bpd of excess cross boarder capacity would seem to be sufficient. However, with Canadian production expected to double, and with the long lead times which are often needed to build a pipeline, it’s important keep ahead of this production increase to keep as much of the oil in North America as possible. Regardless of this sentiment, three pipeline expansions totaling nearly 1.5 million Bpd of capacity are in development. The TransCanada’s Keystone XL pipeline is intended to service the USGC and upper Midwestern refinery markets. The Canadian oil producers are especially excited about the Enbridge (“ENB”) and Kinder Morgan (“KMI”) pipelines as they are largely intended to create a second market for Canadian crude by servicing Asia’s growing demand. Having a second buyer for its crude is likely to benefit Canadian oil producers by introducing some price competition for Canadian crude.

The TransCanada’s Keystone XL pipeline is intended to service the USGC and upper Midwestern refinery markets. The Canadian oil producers are especially excited about the Enbridge (“ENB”) and Kinder Morgan (“KMI”) pipelines as they are largely intended to create a second market for Canadian crude by servicing Asia’s growing demand. Having a second buyer for its crude is likely to benefit Canadian oil producers by introducing some price competition for Canadian crude.

Southbound Crude Pipelines

In addition to needing cross border pipeline connectivity, selling crude to the USGC will require an enhancement of the North south capacity from Midwest/Cushing to USGC. Lack of north to south pipeline capacity south of Cushing has been causing oil inventories in Cushing to pile up.

To date, the reversal of Enterprise Products (“EPD”)/Enbridge Seaway pipeline has increased the Cushing to USGC capacity by 150k Bpd. This is hardly sufficient to keep up with the increase production, but Seaway is due to increase its capacity to 400k Bpd by early 2013 and to 850k Bpd by 2014.

To date, the reversal of Enterprise Products (“EPD”)/Enbridge Seaway pipeline has increased the Cushing to USGC capacity by 150k Bpd. This is hardly sufficient to keep up with the increase production, but Seaway is due to increase its capacity to 400k Bpd by early 2013 and to 850k Bpd by 2014.- While the cross boarder portion of Keystone XL is still waiting approval, Keystone’s Cushing MarketLink pipeline is due to be completed in 2013. This will bring an additional 500k Bpd of crude south from Cushing to the UGCC.

- Finally, according to a FERC regulatory filing, Energy Transfer (“ETP”) is in the process of getting FERC approval to reverse the flow and change the service of one of the three parallel pipelines of its Trunkline gas pipeline system. Once approved, using an existing and contiguous pipeline should allow ETP to begin shipping oil south from Tucola, Illinois to connect with Sunoco Logistics’ crude oil system in the Buna, Texas region by early 2014. Without entering into a partnership with a Bakken or Canadian crude gather, not having direct access to Canadian crude may hinder ETP vis-à-vis Enbridge and TransCanada as ETP’s two competitors will be able to offer a one stop shop to get crude from Canada to the USGC.

When all three of these southbound pipelines enter service, they should bring an additional 1.6 million Bpd of oil to the USGC. This should be sufficient to keep up with production increases for the next few years, but may be insufficient in the medium to longer term.

PADD I Market Potential

An additional but much smaller market, for some of the growing North American oil production could be PADD I refineries on the east coast. These refineries have never had very good terrestrial crude oil access to the rest of the country. As a result, they have imported a lot of oil from North and West Africa. Because these refiners have not spent capital to upgrade their ability to refine heavier and cheaper grades of crude, they would not be able to take advantage of much of the new heavy oil production from Canada. Rather, they will be forced to buy from the Bakken and once its up and running, from the Utica. They will also be able to take advantage of some of the lighter crudes which are being displaced for heavier crudes in PADD II. All this said, PADD I refiners will probably the most eager buyers of domestic crude as they currently have to pay for premium seaborne crudes which are priced at a premium to North American crudes.