Here’s a link to an article I posted on another site:

http://seekingalpha.com/article/1043301-energy-transfer-partners-the-path-to-a-distribution-increase

Here’s a link to an article I posted on another site:

http://seekingalpha.com/article/1043301-energy-transfer-partners-the-path-to-a-distribution-increase

Here’s a link to an article I posted for another site:

http://seekingalpha.com/article/1059871-regency-energy-partners-the-path-to-distribution-growth

Here’s a link to a article I posted for another site:

Though there can be no doubt that the Platte/Express crude oil pipeline system which brings crude from Western Canada and the Bakken to markets in the Rockies and eventually the Mid-West is a very valuable asset, it would seem that Kinder Morgan (“KMP”) was able to extract a full price for the system from Spectra Energy (“SE”). As a result, its strange that KMP

KMP was able to sell its interest in the pipeline system for $380 million, or at a distribution yield of 3.9%. This is well below the partnerships distribution yield of 6.3%. Like with bonds, yield and price are inversely correlated, with a lower yield indicating a higher relative valuation.

SE has indicated they are paying a total of ~$1.5 billion for an asset which it expects to generate ~$130 million of EBITDA, or an 11.5x multiple. Growing crude production in Western Canada and the Bakken have caused the Platte portion of the system to be over subscribed as of late, indicating there is minimal room for upside either through additional volumes or through higher tariffs. It is likely SE will try to expand the system to take advantage of this abundance of demand for its services. Looping entire 1,717-mile pipeline system, which begins in Hardisty, Alberta, and terminates in Wood River, IL is not likely to be inexpensive; and given the regulatory difficulties Keystone XL has experienced, the regulatory approval of such an expansion is not likely to be easy. We estimate that an expansion of the full system could cost $2.5-3.5 billion and take two to four years to complete. During this approval/construction period, SE would likely see some dilution to its earnings and DCF as it has to raise capital well in advance of project completion.

However, because Express portion of the system is currently operating at 70% of its 280,000 Bpd of capacity, it may be possible to initially only expand the over subscribed 900 mile 145,000 Bpd Platte section of the system. Expanding the Platte pipeline would allow SE to take advantage of Express’s ability to bring an additional 84,000 Bpd of Canadian crude to the Mid-West. – We estimate the utilization of the Express pipeline’s 84,000 Bpd of excess capacity could generate $15-25 million of annual EBITDA. Depending on capacity of the expansion, we estimate a looping of the 900 mile Plate system could cost as much as $1-1.5 billion. Though this would likely be accretive once completed, SE is still likely to experience some dilution to DCF as it still has to raise capital well in advance of project completion.

Here’s a link to an article I wrote for another site:

With crude oil production reaching 1.3 million Bpd in September 2012, and with future production expected to top 2 million Bpd in the next few years, the venerable Permian Basin is the West Texas gift which keeps on giving. Unlike the Bakken which had very little existing infrastructure to help producers to get their crude oil to market, the Permian has been producing oil for over 80 years. While Permian crude oil production last topped 2 million Bpd in the 70s, the Permian’s production hasn’t topped 1 million Bpd since 1998, and the recent decrease in production has meant the Permian’s current infrastructure is insufficient to keep up with its anticipated growth in crude oil production.

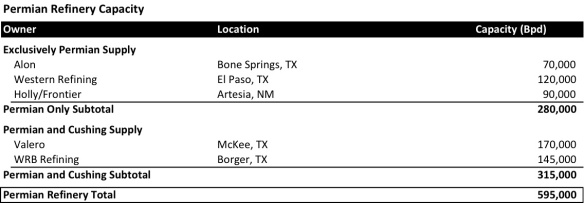

End market demand for Permian crude is expected to come both locally, from three refineries which depend exclusively on Permian crude and possibly from two refineries which use both Permian and Cushing crude, as well as from refinery markets on the US Gulf Coast. It is even possible that, in the medium to longer term, that pipelines could be developed (or repurposed) so that California based refineries could gain access to the bounty of the Permian’s second life.

Local Refineries

There are currently three refineries which depend on the Permian as their source of oil. These three refineries form a 280,000 Bpd foundation of demand for Permian crude. Alon (“ALJ”) has a 70,000 Bpd refinery in the heart of the Permian in Bone Springs, TX. Western Refining (“WNR”) also has 120,000 Bpd refinery in El Paso, TX which is serviced by Kinder Morgan’s (“KMP”) Wink pipeline. Finally, Holly/Frontier (“HFC”) has a 90,000 Bpd refinery in Artesia, NM which also depends on the Permian for its oil.

There are currently three refineries which depend on the Permian as their source of oil. These three refineries form a 280,000 Bpd foundation of demand for Permian crude. Alon (“ALJ”) has a 70,000 Bpd refinery in the heart of the Permian in Bone Springs, TX. Western Refining (“WNR”) also has 120,000 Bpd refinery in El Paso, TX which is serviced by Kinder Morgan’s (“KMP”) Wink pipeline. Finally, Holly/Frontier (“HFC”) has a 90,000 Bpd refinery in Artesia, NM which also depends on the Permian for its oil.

Also in the Permian area, but also with connections to Cushing, OK, are Valero (“VLO”) and WRB’s two refineries which total of 315,000 Bpd of refining capacity. Valero’s 170,000 Bpd refinery is located in McKee, TX and WRB’s 145,000 Bpd refinery is located in Borger, TX. Because of the abundance of crude at Cushing, it is likely that crude passing through Cushing will continue to be priced at a discount to Permian Basin crude. As a result, we believe these two refineries will be more opportunistic in their consumption of Permian Basin crude oil.

Pipelines

To get Permian crude oil out of the region to some of the larger refinery markets on the Gulf Coast or in the Midwest, producers must rely on a network of pipelines.

There are currently just three pipelines with a total of 925,000 Bpd of takeaway capacity out of the Permian: (1) Plains All American’s (“PAA”) 450,000 Bpd Basin Pipeline, (2) Sunoco Logistics’ (“SXL”) 300,000 Bpd West Texas Gulf Pipeline, and Occidental’s (“OXY”) 175,000 Bpd Centurion Pipeline. These three pipelines take Permian crude to the Midwest. None of these pipelines deliver crude to the US Gulf Coast, but rather, two, Basin and Centurion, deliver crude to Cushing, OK, and West Texas Gulf delivers crude to Longview, TX, for eventual delivery via the Mid-Valley Pipeline to the Mid West.

As we know, Mid-West refiners have been building cokers to take advantage of the growing production of lower priced heavy crudes from Canada. Three coker projects (Wood River, BP-Whiting, and Marathon-Detroit) are expected to increase heavy crude demand by 500,000 Bpd, while decreasing light crude demand by 455,000 Bpd. This will decrease demand for Permian Crude via Cushing.

Also, because take away capacity from Cushing is limited, the Cushing market is currently over supplied, pushing down the price of crude in the market. As a result, because pricing on the Gulf Coast is stronger than in Cushing, Permian producers would rather send their crude directly to the US Gulf Coast. As a result, as non-Cushing pipeline alternatives are constructed, we believe it is likely that demand for space on the Permian to Cushing pipelines may begin to fall off, to the benefit of the Permian to USGC pipelines.

Pipeline Projects

There are four multiphase pipeline being constructed to bring Permian oil to the Texas Gulf Coast Refinery markets: (1) West Texas Gulf is doing a three phase expansion, (2) Magellan Midstream (“MMP”) is reversing its Longhorn Pipeline, (3) SXL is building a two phase Permian Express Pipeline, and (4) MMP and OXY are building the BridgeTex Pipeline.

West Texas Gulf is building three expansions:

Longhorn Reversal. MMP finalized plans to reverse the flow of its Houston-to-El Paso Longhorn refined products pipeline. As part of this process, MMP also plans to convert Longhorn to crude oil transportation. This $275 million conversion and reversal project will initially have the capacity to ship 135,000 Bpd of crude oil from Crane, TX to MMP’s East Houston terminal and is expected to be operational by mid-2013. The Longhorn reversal is expected to be expanded to ship up to 225,000 Bpd of crude oil by the end of 2013.

Permian Express. SLX’s Permian Express will be divided into two phases, both of which will increase the flow of crude oil from west Texas to Gulf Coast markets.

Together with West Texas Gulf, once fully constructed, Permian Express Phases I and II will give SXL 760,000 Bpd of Permian takeaway capacity.

BridgeTex. MMP and OXY are jointly developing BridgeTex, a new pipeline system for transporting crude oil from Colorado City TX to the Houston Gulf Coast area. The BridgeTex Pipeline System will be a 400 mile, 20-inch pipeline which will terminate at MMP’s East Houston Terminal. Together with its Longhorn reversal, BridgeTex will give MMP 503,000 Bpd of Permian takeaway capacity. Note: Occidental is one of the largest, if not the largest producer of crude oil in the Permian Basin.

Since the beginning of 2011, Sunoco Logistics (“SXL”) has initiated seven major organic growth projects, all of which have had successful open seasons. In aggregate, these seven projects will have 475,000 Bpd of takeaway capacity.

In addition to these seven projects, SXL is also contemplating a second phase to its Permian Express project which will have 200,000 Bpd of takeaway capacity. Additionally, SXL’s General Partner, Energy Transfer Partners (“ETP”) is in the process of getting regulatory approval to reverse and convert the service of part of its Trunkline natural gas pipeline. Further, ETP is also considering a project based around its Transwestern gas pipeline.

West Texas: SXL’s West Texas – West Texas – Houston Access and Longview Access projects are being developed to deliver crude oil from West Texas to the Mid-Valley Pipeline at Longview, Texas and to the Houston, Texas market. The projects will have initial capacity to transport approximately 40,000 barrels per day to Houston, and approximately 30,000 barrels per day to Longview. The West Texas – Houston Access project is scheduled to be operational by April 2012, and the West Texas – Longview Access project is scheduled to be operational by January 2013. The West Texas – Nederland Access project is being developed to deliver crude oil from West Texas to SXL’s Nederland Terminal at Nederland, Texas. The project is anticipated to have initial capacity to transport approximately 40,000 barrels per day to Nederland. The West Texas – Nederland Access project is scheduled to be operational in first quarter 2013. All of these projects will have the ability to expand to support higher volumes as needed.

Permian Express Phase 1: Permian Express Phase 1 will provide continuous pipeline service from Wichita Falls, Texas to the Nederland/Beaumont, Texas markets. At Wichita Falls, a connection from Plains All American’s Basin Pipeline will be provided. Due to the use of existing assets, the this project will have the ability to transport ~90,000 Bpd to Nederland/Beaumont, TX and will be operational in Q1:2013. Full capacity of 150,000 barrels per day is expected by the end of 2013.

Mariner West: Mariner West is a pipeline project which is being developed jointly by SXL and MarkWest Liberty Midstream & Resources, LLC, a partnership between MarkWest Energy Partners, L.P. (“MWE”) and The Energy & Minerals Group. This project will deliver ethane from the liquid-rich Marcellus Shale processing and fractionation areas in Western Pennsylvania to the Sarnia, Ontario petchem market. Mariner West has received binding commitments that enable the project to proceed as with an initial capacity to transport approximately 50,000 Bpd. Mariner West will have the ability to expand to support higher volumes as needed.

Allegheny Access: Allegheny Access is a pipeline project which will transport refined products from refineries in the Midwest to eastern Ohio and western Pennsylvania markets. Because the project will use a combination of new and existing assets in Ohio and Pennsylvania, Allegheny Access pipeline is expected to be operational in the first half of 2014. Allegheny Access is expected to have an initial capacity to deliver 85,000 Bpd with the ability to scale up to 110,000 Bpd.

Mariner East: Mariner East is a pipeline project which will deliver propane and ethane from the liquid-rich Marcellus Shale areas in Western Pennsylvania to SXL’s facility in Marcus Hook, PA, where it will be processed, stored, and distributed to various domestic and waterborne markets. Mariner East is anticipated to have an initial capacity to transport approximately 70,000 Bpd of natural gas liquids and can be expanded to support higher volumes. The project is expected to begin transporting propane by the second half of 2014 and to be fully operational to deliver both propane and ethane in the first half of 2015. This new capacity will enhance the current propane export capabilities at Marcus Hook.

SXL expects to invest over $600 million for the both of the Mariner projects.

Permian Express Phase 2: A second phase could deliver additional West Texas crude oil to key Gulf Coast destinations such as the Nederland/Beaumont market and further east to the refining centers in Louisiana up to St. James using a combination of new and existing pipelines. For Permian Express Phase II, Sunoco Logistics could twin a 300-mile pipeline, parallel to the existing West Texas Gulf pipeline, from Colorado City to Wortham where it could connect to the existing excess capacity of the southern leg of the West Texas Gulf pipeline system. Permian Express Phase II could have initial takeaway capacity of approximately 200,000 barrels per day and be operational in the second half of 2014. The project is anticipated to have initial capacity to transport approximately 40,000 barrels per day to Nederland. The West Texas – Nederland Access project is scheduled to be operational in first quarter 2013. This project will provide West Texas producers and Gulf Coast refiners with a crude oil supply solution for West Texas Sweet and Sour crude.

Trukline Conversion: As we wrote in a previous post, on its most recent earnings call, SXL’s General Partner, ETP, officially announced its pursuit of a project under which it would announced convert and reverse part, one loop, of its Trunkline natural gas pipeline. At that time, management stated that it expects the pipeline’s capacity to be 400,000-600,000 Bpd, but that the pipeline’s initial capacity will be closer to the lower end of the range. Management expects the total cost of this project will be ~$1.5 billion. With the closing of ETP’s acquisition of SXL’s General Partner, we expect this crude oil pipeline conversion could be a dropdown candidate for ETP and SXL, and that SXL will be the ultimate owner and funding source for this conversion.

It is expected this conversion will begin at Tuscola, IL and also connect with the Mid West’s major pipeline hub in Patoka, IL. The Trunkline conversion will follow Trunkline’s path and will pass by the Lake Charles refinery market on its way to terminate at company’s terminal at Nederland, TX. ETP also plans to build a lateral from Trunkline to service the St. James refinery market.

Management expects to obtain FERC approval for the project in Q2:2013, and that the conversion will be in service by mid-2014. Management began this process by filing an application for abandonment with the FERC in July 2012.

Transwestern “Expansion”: At its most recent analyst day, SXL’s General Partner, ETP, mentioned that, in the next couple of years, it expects to “expand” its Transwestern natural gas pipeline. Though demand for natural gas could certainly increase in Arizona, as some of its coal power plants are shut down and/or converted to gas, gas demand in California is decreasing as peak power production in the state is being increasingly produced by renewables. As a result, there is excess capacity on Transwestern, and we expect this “expansion” could manifest itself in a form similar to the Trunkline conversion. California is a big producer of oil, but its production is not growing, and California is physically isolated from the increasing crude production in the Mid-continent and Texas. As a result, it has to import some of its oil and could benefit from an oil or even a refined products pipeline from West Texas. Transwestern’s physical connection to some of the regions where oil production growth is the most rapid, namely the Permian Basin in West Texas and the Texas/Oklahoma Panhandle, make Transwestern optimally positioned for a potential conversion/expansion.

Note: SXL management has stated that it underwrites its organic growth projects to a 6-7x EBITDA multiple.

Hurricane Sandy, and the resulting gasoline shortage in the New York and New Jersey areas has put a spotlight on the refined products infrastructure in the North East. Though a lack of abundant local fuel production and a temporary shutdown of the Colonial pipeline certainly put a crimp on supplies, a lack of power to the local pipelines and fuel terminals had a much bigger effect on the end user. To this end, we thought we would take a look at the arteries of fuel supply in the North East.

Colonial Pipeline is the largest refined products pipeline in the United States. It has 5,500 miles of underground pipe, and has a capacity of greater than 2.3 million barrels per day. Colonial originates in Houston, TX with final delivery in Linden, NJ. The pipeline’s average tariff from Houston to New Jersey is $1.89/barrel, and the average delivery time from Houston to New Jersey is 18 days.

Buckeye (“BPL”) With a history tracing its roots back to 1886, when the Buckeye Pipe Line Company was incorporated as a subsidiary of the Standard Oil Company, BPL has over 6,000 miles of pipeline. Additionally, BPL owns ~100 liquid petroleum products terminals with an aggregate storage capacity of ~64 million barrels. BPL also operates/maintains ~2,800 miles of pipeline for major oil and chemical companies.

In the North East, specifically in Pennsylvania, New York, and New Jersey, Buckeye’s operating subsidiary Buckeye Pipe Line Company, L.P. (“Buckeye Pipe Line”) serves major population centers in Pennsylvania, New York and New Jersey through ~925 miles of pipeline. Buckeye’s pipeline system transports more than 1.4 million bpd of refined products.

Sunoco Logistics (“SXL”) owns and operates ~2,500 miles of refined products pipelines in selected areas of the United States. The company’s refined products pipelines transport nearly 600,000 bpd of refined products from refineries in the northeast, Midwest, and southwest United States to markets in New York, New Jersey, Pennsylvania, Ohio, Michigan, Texas, and Canada. The refined products transported in these pipelines include multiple grades of gasoline, middle distillates (such as heating oil, diesel and jet fuel) and LPGs (such as propane and butane).In addition to its wholly owned refined products pipelines, SXL also owns a two-thirds undivided interest in the Harbor pipeline and joint venture interests in four refined products pipelines in selected areas of the United States.

SXL’s refined products terminal facilities in the north east consist of:

Plantation Pipe Line Company (PPL) Though it doesn’t directly service the North East, PPL is one of the largest refined petroleum products pipelines in the United States. It delivers approximately 600,000 barrels per day of gasoline, jet fuel, diesel and biodiesel through its 3,100-mile pipeline network. PPL originates in Louisiana and ends in the Washington, D.C. area. Along the way PPL serves various metropolitan areas including Birmingham, AL; Atlanta, GA; Charlotte, NC; and the Washington D.C. area. PPL is owned and operated by Kinder Morgan.

This is a continuation of an earlier article on the conversion of Trunkline. According to Energy Transfer’s (“ETE and ETP”) November 14, 2012 Analyst Day presentation, the company’s much anticipated Trunkline conversion will begin at Tuscola, IL and also connect with the Mid West’s major pipeline hub in Patoka, IL. The Trunkline conversion will follow Trunkline’s path and will pass by the Lake Charles (2.0+ million Bpd) refinery market on its way to terminate at company’s terminal at Nederland, TX. ETP also plans to build a lateral from Trunkline to service the St. James refinery market (2.1 million Bpd). Laterals to individual refineries within each market are likely to be built only as refiners commit to pipeline capacity on the conversion.

Management stated on its Q3:2012 earnings call that it expects the pipeline’s capacity to be 400,000-600,000 Bpd. Management also expects the pipeline’s initial capacity will be closer to the lower end of the range, but will ultimately be determined by level of shipper interest.

With an expected total project cost estimated to be ~$1.5 billion, management expects to obtain FERC approval for the abandonment of some of Trunkline’s gas service in Q2:2013, and that the conversion will be in service by mid-2014. Management began this process by filing an application for abandonment with the FERC in July 2012.

Given the project’s cost and an 8.0x EBITDA multiple, we conservatively expect this project could begin to contribute $45 million of EBITDA per quarter, beginning in Q3:2014. As the project ramps from 400,000 Bpd to its full capacity of 600,000 Bpd, we expect this project’s EBITDA contribution could ramp to $65 million per quarter.

With the closing of ETP’s acquisition of Sunoco and Sunoco Logistics’ (“SXL”) General Partner in October, 2012, we expect this crude oil pipeline conversion could be a dropdown candidate for ETP and SXL. Once the abandonment has been approved, the most capital efficient way of financing this conversion would be for ETP Holdco to sell SXL the rights to the Trunkline Conversion in return for cash. We believe SXL’s low leverage (~2.0x LTM EBITDA), its rapidly increasing cash flow, and its high distribution coverage ratio could allow SXL to finance this pipeline conversion without raising any additional equity, while keeping its leverage ratio below 4.0x.

Based on SXL’s Q3:2012 IDR Waterfall, we expect this project could initially increase quarterly distributions per common unit by $0.18 per unit, and that SXL’s IDR could increase by 90% to over $38 million per quarter. Given that SXL’s common unit distribution ($0.5175/unit) is very close to the top tier ($0.5275/unit) of SXL’s IDR Waterfall, we expect this project to be a big cash flow contributor to SXL’s General Partner, ETP.

On the heels of the announcement of BP’s two refinery sales, last week, the Wall Street Journal reported that VLO had retained Citigroup to explore the sale of its two California refineries in Wilmington and Benecia.

Perhaps the biggest reason behind this divestiture are California’s increasingly stringent environmental rules. However, California’s lack of pipeline connectivity to the rest of the country should not to be discounted. This lack of pipeline connectivity isolates California from the increasingly abundant supply of oil production in Canada, the Mid-Continent, and from Texas. As a result, California has needed to rely on in-state oil production as well as more expensive imported oil, decreasing the potential profitability of refining oil.

Based on BP’s two recently announced refinery sales, we estimate the sale of VLO’s two California refineries could bring VLO between $1.3-2.8 Billion, depending on the amount of inventory and ancillary assets which are associated with each refinery. However, because of the potentially tough regulatory environment associated with producing gasoline in California, and the FTC’s intersession on the sale of BP’s Long Beach refinery to Tessoro, it seems likely the universe of potential purchasers could be limited. A limited universe of potential purchasers could put pressure on the eventual purchase price(s), and the purchase price of refineries alone could could be on the low end of the $0.4-1.5 Billion range.

In addition to the base price for the refinery, a good proportion of the aggregate purchase price for each refinery will be the refinery’s associated inventories. In general, we estimate that each refinery will keep 30-45 days of inventory on hand to keep the refinery operating.

In addition to the base price for the refinery, a good proportion of the aggregate purchase price for each refinery will be the refinery’s associated inventories. In general, we estimate that each refinery will keep 30-45 days of inventory on hand to keep the refinery operating.

Associated inventories could add a total of $0.9-1.3 Billion to purchase price of Valero’s two California refineries. This could bring the aggregate purchase price of the two refineries.

Associated inventories could add a total of $0.9-1.3 Billion to purchase price of Valero’s two California refineries. This could bring the aggregate purchase price of the two refineries.