As the Bakken’s oil production growth continues to exceed expectations, oil production is now expected to eventually double or even triple to 1.2 – 2.0 million Bpd. The Bakken’s rapid growth is, however, being constrained by an inability to cheaply and efficiently move the oil out of the region. To this end, we thought we’d take a look at some of the infrastructure alternatives, and see if there might be an intriguing opportunities. Generally, lighter crude oils such as those produced by the Bakken have the greatest demand in the east in PADDs I and II. This is because many of the PADD I and Ohio refineries have less ability to process heavier oils, as measured by their lower Nelson Complexity Ratings. Generally, heavier oils will go south to the PADD III refineries on the USGC which have been upgraded to process heavier oils.

There are two main ways to transport oil out of the Bakken: (1) by train, and (2) by pipeline.

Currently, because the Dakotas were never a historically prolific oil producing region, oil pipeline capacity out of the Bakken is limited to Enbridge’s (“ENB”) 200,000 Bpd pipeline, and many shippers have had to resort to shipping their oil to the USGC, or even the USEC, by rail. However, there are at least three pipeline systems under construction, and by 2015, pipeline capacity is expected to carry nearly all of the oil production from the Bakken.

Currently, because the Dakotas were never a historically prolific oil producing region, oil pipeline capacity out of the Bakken is limited to Enbridge’s (“ENB”) 200,000 Bpd pipeline, and many shippers have had to resort to shipping their oil to the USGC, or even the USEC, by rail. However, there are at least three pipeline systems under construction, and by 2015, pipeline capacity is expected to carry nearly all of the oil production from the Bakken.

Rail vs Pipeline Costs

One might ask why rail, as the incumbent carrier, wouldn’t be able to keep its current share of oil transportation customers. The answer is cost. Transporting oil by rail is dramatically more expensive than transporting oil by pipeline. Though much more expensive than a pipeline on a per barrel basis, rail has one big advantage. Many rail systems are already in place and need a minimal amount of capital upgrades to begin transporting oil. That said, as the $10 differential between the rail cost to St. James and the pipeline cost to the USGC shows, once up and running, pipelines are a much cheaper, more efficient, and more reliable way of transporting oil. However, pipelines are expensive to build, and take a fair amount of time to get permitted and into service.

One might ask why rail, as the incumbent carrier, wouldn’t be able to keep its current share of oil transportation customers. The answer is cost. Transporting oil by rail is dramatically more expensive than transporting oil by pipeline. Though much more expensive than a pipeline on a per barrel basis, rail has one big advantage. Many rail systems are already in place and need a minimal amount of capital upgrades to begin transporting oil. That said, as the $10 differential between the rail cost to St. James and the pipeline cost to the USGC shows, once up and running, pipelines are a much cheaper, more efficient, and more reliable way of transporting oil. However, pipelines are expensive to build, and take a fair amount of time to get permitted and into service.

The $14/Barrel differential in rail pricing to USEC vs to pipeline pricing to Petoka, IL creates opportunity to bring oil into Ohio and to the USEC. Petoka is about the farthest east that one can transport Bakken oil by pipeline. As was mentioned above, the the lack of heavy oil processing capability makes the Ohio and the PADD I/east coast refinery markets an appealing 1.5 million Bpd opportunity for Bakken oil. This said, once up and producing in the next three to seven years, the oil production from the Utica could satisfy 300k of this demand. Nevertheless, a 1.2 million Bpd market should be more than sufficient to support the construction of a pipeline to the east coast from the Midwest.

Bakken to the Midwest

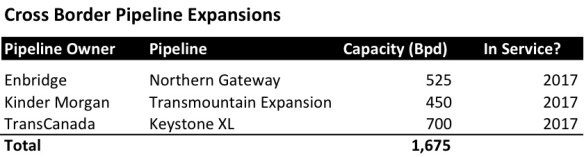

To get oil to the USEC and to Ohio, transiting through Cushing, OK seems unnecessary, adding additional distance and cost to the trip. That said, skipping Cushing will eliminate OneOK (“OKE”) and TransCanada’s (“TRP”) Keystone XL pipelines as potential carriers out of the Bakken. Skipping OKE and Keystone XL will leave ENB as the main pipeline alternative out of the Bakken.

If one takes either OKE’s or Keystone XL’s pipeline from the Bakken to Cushing, to get east, one will need to use ENB’s Ozark Pipeline to Wood River, IL or BP’s pipeline to get to Whiting, IL. Using either of these two alternatives does not seem like a cost effective alternative to using one of ENB’s pipelines the whole way from the Bakken. ENB’s mainline can get crude from the Bakken to Toledo, OH, or to either Chicago or Patoka, IL.

The High Prairie Pipeline, a yet to be built pipeline out of the Bakken is currently fighting with ENB to interconnect with ENB’s mainline at Clearbrook, MN. Another option for High Praire to move its crude south and/or east might be to interconnect with the Koch (Minnesota/Koch) pipeline system. Koch’s Minnesota Pipeline begins at Clearbrook, MN, and then interconnects with the Koch Pipeline in St. Paul, MN. The Koch Pipeline terminates at Wood River, IL. Because there are a lot of historical relationships between High Prairie’s management team and Koch, many members of High Prairie’s management team used to work at Koch, we feel like this could be a easier and better alternative than interconnecting with ENB.

Possible East Coast Pipeline Partners:

As oil production in the Utica ramps up, it is likely that local refiners in Ohio (Marathon, Husky, BP/Husky, and PBF) will absorb most of the 300k Bpd of light oil produced by this formation.This however, does not mean that there isn’t a need for pipeline infrastructure to get oil from Ohio to the PADD I refineries, most of which seem to be clustered in and around the Philadelphia area. This pipeline need will play to companies who already service some or all of these refineries for either crude delivery or refined product take away capacity and to those companies who can aggregate disparate pipeline networks and rights of way. We see some possible players as being the following:

- Marathon Petroleum (“MPC”)

- Has rights of way, and crude and refined products pipeline connections to terminals and refineries in Ohio.

- Marathon Pipeline connects Petoka, IL to Marathon’s refineries in Ohio.

- Does not have pipeline connectivity east of Ohio.

- Sunoco (“SUN/SXL”)

- Has rights of way and pipeline connections from many of the Philadelphia area refineries to markets in Pennsylvania, Ohio, and Michigan.

- Also controls the Inland Pipeline, a refined products pipeline which connects three refineries to eastern Ohio and western Pennsylvania markets.

- Could be possible to use rights of way and underutilized/unused pipe to get crude from either Toledo or one of Inland’s Ohio refineries to Philadelphia.

- Buckeye (“BPL”)

- Has rights of way and refined products connections to terminals and refineries in Pennsylvania, Ohio, New York, and New Jersey.

- Enterprise Products (“EPD”)

- EPD owns the interstate ATEX pipeline.

- Though it crosses Indiana, Ohio, and Pennsylvania, ATEX is primarily a NGL pipeline and does appear to connect to refineries.

Conclusion

ENB seems poised to be the dominant transporter of crude, not only from Canada, but also out of the Bakken. However, a good counter balance would seem to be a combination of the MPC pipeline network and either the SUN/SXL or BPL pipeline network. This combination would create a pipeline network which serves a thirsty but under-served region with 1.5+ million Bpd of light oil demand.