With crude oil production reaching 1.3 million Bpd in September 2012, and with future production expected to top 2 million Bpd in the next few years, the venerable Permian Basin is the West Texas gift which keeps on giving. Unlike the Bakken which had very little existing infrastructure to help producers to get their crude oil to market, the Permian has been producing oil for over 80 years. While Permian crude oil production last topped 2 million Bpd in the 70s, the Permian’s production hasn’t topped 1 million Bpd since 1998, and the recent decrease in production has meant the Permian’s current infrastructure is insufficient to keep up with its anticipated growth in crude oil production.

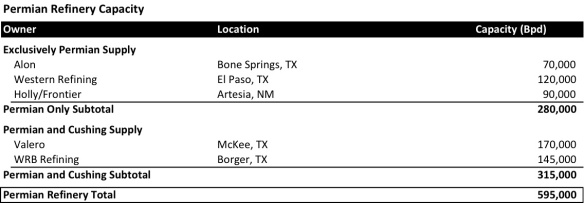

End market demand for Permian crude is expected to come both locally, from three refineries which depend exclusively on Permian crude and possibly from two refineries which use both Permian and Cushing crude, as well as from refinery markets on the US Gulf Coast. It is even possible that, in the medium to longer term, that pipelines could be developed (or repurposed) so that California based refineries could gain access to the bounty of the Permian’s second life.

Local Refineries

There are currently three refineries which depend on the Permian as their source of oil. These three refineries form a 280,000 Bpd foundation of demand for Permian crude. Alon (“ALJ”) has a 70,000 Bpd refinery in the heart of the Permian in Bone Springs, TX. Western Refining (“WNR”) also has 120,000 Bpd refinery in El Paso, TX which is serviced by Kinder Morgan’s (“KMP”) Wink pipeline. Finally, Holly/Frontier (“HFC”) has a 90,000 Bpd refinery in Artesia, NM which also depends on the Permian for its oil.

There are currently three refineries which depend on the Permian as their source of oil. These three refineries form a 280,000 Bpd foundation of demand for Permian crude. Alon (“ALJ”) has a 70,000 Bpd refinery in the heart of the Permian in Bone Springs, TX. Western Refining (“WNR”) also has 120,000 Bpd refinery in El Paso, TX which is serviced by Kinder Morgan’s (“KMP”) Wink pipeline. Finally, Holly/Frontier (“HFC”) has a 90,000 Bpd refinery in Artesia, NM which also depends on the Permian for its oil.

Also in the Permian area, but also with connections to Cushing, OK, are Valero (“VLO”) and WRB’s two refineries which total of 315,000 Bpd of refining capacity. Valero’s 170,000 Bpd refinery is located in McKee, TX and WRB’s 145,000 Bpd refinery is located in Borger, TX. Because of the abundance of crude at Cushing, it is likely that crude passing through Cushing will continue to be priced at a discount to Permian Basin crude. As a result, we believe these two refineries will be more opportunistic in their consumption of Permian Basin crude oil.

Pipelines

To get Permian crude oil out of the region to some of the larger refinery markets on the Gulf Coast or in the Midwest, producers must rely on a network of pipelines.

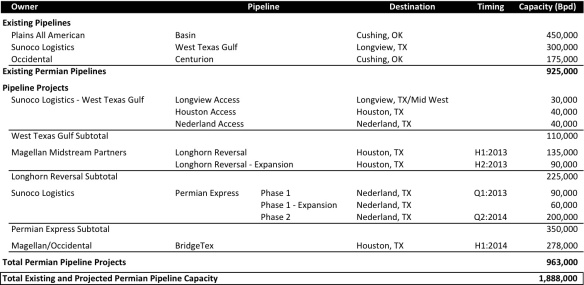

There are currently just three pipelines with a total of 925,000 Bpd of takeaway capacity out of the Permian: (1) Plains All American’s (“PAA”) 450,000 Bpd Basin Pipeline, (2) Sunoco Logistics’ (“SXL”) 300,000 Bpd West Texas Gulf Pipeline, and Occidental’s (“OXY”) 175,000 Bpd Centurion Pipeline. These three pipelines take Permian crude to the Midwest. None of these pipelines deliver crude to the US Gulf Coast, but rather, two, Basin and Centurion, deliver crude to Cushing, OK, and West Texas Gulf delivers crude to Longview, TX, for eventual delivery via the Mid-Valley Pipeline to the Mid West.

As we know, Mid-West refiners have been building cokers to take advantage of the growing production of lower priced heavy crudes from Canada. Three coker projects (Wood River, BP-Whiting, and Marathon-Detroit) are expected to increase heavy crude demand by 500,000 Bpd, while decreasing light crude demand by 455,000 Bpd. This will decrease demand for Permian Crude via Cushing.

Also, because take away capacity from Cushing is limited, the Cushing market is currently over supplied, pushing down the price of crude in the market. As a result, because pricing on the Gulf Coast is stronger than in Cushing, Permian producers would rather send their crude directly to the US Gulf Coast. As a result, as non-Cushing pipeline alternatives are constructed, we believe it is likely that demand for space on the Permian to Cushing pipelines may begin to fall off, to the benefit of the Permian to USGC pipelines.

Pipeline Projects

There are four multiphase pipeline being constructed to bring Permian oil to the Texas Gulf Coast Refinery markets: (1) West Texas Gulf is doing a three phase expansion, (2) Magellan Midstream (“MMP”) is reversing its Longhorn Pipeline, (3) SXL is building a two phase Permian Express Pipeline, and (4) MMP and OXY are building the BridgeTex Pipeline.

West Texas Gulf is building three expansions:

- Longview Access. SXL is expanding West Texas Gulf’s capacity to Longview, TX by 30,000 Bpd. This capacity can be used to either send Permian crude to the Mid-West via the Mid Valley Pipeline; or, it appears that crude will also be able to get to the New Orleans/St. James refinery markets via Longview.

- Houston Access. SXL is expanding West Texas Gulf’s capacity to the 2.3 million Bpd Houston refinery market by 40,000 Bpd.

- Nederland Access. SXL is also expanding capacity West Texas Gulf’s capacity to its 22 million barrel Nederland terminal by 40,000 Bpd. From Nederland, crude can use various pipelines get to Exxon’s Beaumont, TX refinery, the Big Hill and West Hackberry Strategic Petroleum Reserve caverns, Valero’s Port Arthur, TX refinery, Total’s Port Arthur, TX refinery, and Shell/Modtiva’s various Houston, TX refineries. The Motiva refinery recently increased its capacity by 325,000 Bpd to 600,000 Bpd.

Longhorn Reversal. MMP finalized plans to reverse the flow of its Houston-to-El Paso Longhorn refined products pipeline. As part of this process, MMP also plans to convert Longhorn to crude oil transportation. This $275 million conversion and reversal project will initially have the capacity to ship 135,000 Bpd of crude oil from Crane, TX to MMP’s East Houston terminal and is expected to be operational by mid-2013. The Longhorn reversal is expected to be expanded to ship up to 225,000 Bpd of crude oil by the end of 2013.

Permian Express. SLX’s Permian Express will be divided into two phases, both of which will increase the flow of crude oil from west Texas to Gulf Coast markets.

- Permian Express Phase I. Phase I will initially have have the ability to transport 90,000 Bpd of crude from Wichita Falls, TX to the Nederland/Beaumont, TX markets. SXL expects to start the first part of Phase I in Q1:2013. Phase I is expected to expand to reach its full capacity of 150,000 Bpd by late 2013 or mid 2014.

- Permian Express Phase II. Permian Express Phase II will use a combination of existing and new pipe to boost capacity by at least 200,000 Bpd and would deliver crude as far east as St. James, LA. For Phase II, SXL could twin 300-miles of pipeline, parallel to the existing West Texas Gulf pipeline from Colorado City, TX, to Wortham, TX. From Wortham it would connect to existing excess capacity of the southern leg of the West Texas Gulf pipeline system. Sunoco expects Phase II to be operational by H2:2014.

Together with West Texas Gulf, once fully constructed, Permian Express Phases I and II will give SXL 760,000 Bpd of Permian takeaway capacity.

BridgeTex. MMP and OXY are jointly developing BridgeTex, a new pipeline system for transporting crude oil from Colorado City TX to the Houston Gulf Coast area. The BridgeTex Pipeline System will be a 400 mile, 20-inch pipeline which will terminate at MMP’s East Houston Terminal. Together with its Longhorn reversal, BridgeTex will give MMP 503,000 Bpd of Permian takeaway capacity. Note: Occidental is one of the largest, if not the largest producer of crude oil in the Permian Basin.